Standard Costing

Variance analysis refers to the investigation of deviations (differences) in financial performance from the standards defined in budgets. It involves the isolation of different causes for the variation in income and expenses over a given period from the budgeted standards.

In order to make variances meaningful, the concept of 'flexed budget' is used when calculating variances. Flexed budget acts as a bridge between the original budget (fixed budget) and the actual results.

Main types of Variance

1 | Sales Variance | Sales Price Variance | Sales Volume Variance |

2 | Material Variance | Material Price Variance | Material Usage Variance |

3 | Labour Variance | Labour Rate Variance | Labour Efficiency Variance |

4 | Variable Overhead Variance | Variable Overhead Spending Variance | Variable Overhead Efficiency Variance |

5 | Fixed Overhead Variance | Fixed Overhead Spending Variance | Fixed Overhead Volume Variance

|

A – B = Sales Price Variance

B – C = Sales Volume Variance

NOTE : If answer is positive(+ve) – Favourable (F) , negative (-ve) – Adverse (A)

Sales Price Variance is the measure of change in sales revenue as a result of variance between actual and standard selling price. Favorable sales price variance suggests higher selling price realized during the period than anticipated in the standard. Adverse sales price variance indicates that sales were made at a lower average price than the standard.

Reasons for favorable sales price variance may include:

- Decrease in the number of competitors in the market

- Improved product differentiation and market segmentation

- Better promotion and aggressive sales campaign

Causes for adverse sales price variance may include:

- Increase in competition in the market

- Decrease in demand for the products

- Reduction in price enforced by regulatory authorities

Sales Volume Variance is the measure of change in profit or contribution as a result of the difference between actual and budgeted sales quantity. Favorable sales volume variance suggests a higher standard profit or contribution than the budgeted profit or contribution. Adverse sales volume variance indicated a lower standard profit or contribution than the budgeted profit or contribution.

Reasons for favorable sales volume variance include:

- Favorable sales quantity variance (i.e. higher total number of units sold than budgeted)

- Favorable sales mix variance> (i.e. higher proportion of the more profitable products sold than planned in the budget)

Causes for an adverse sales volume variance include:

- Adverse sales quantity variance (i.e. lower total number of units sold than budgeted)

- Adverse sales mix variance (i.e. higher proportion of the less profitable products sold than anticipated in the budget)

A – B = Material Price Variance

B – C = Material Usage Variance

NOTE : If answer is positive(+ve) – Adverse (A), Negative (-ve) – Adverse (A) – Favourable (F)

Direct Material Price Variance is the difference between the actual cost of direct material and the standard cost of quantity purchased or consumed. A favorable material price variance suggests cost effective procurement by the company. An adverse material price variance indicates higher purchase costs incurred during the period compared with the standard.

Reasons for a favorable material price variance may include:

- An overall decrease in the market price level

- Purchase of materials of lower quality than the standard (this will be reflected in adverse material usage variance)

- Better price negotiation by the procurement staff

- Implementation of better procurement practices (e.g. invitation of price quotations from multiple suppliers)

- Purchase discounts on larger orders

Reasons for adverse material price variance include:

- An overall hike in the market price of materials. Loss of purchase discounts due to smaller order sizes

- Purchase of materials of higher quality than the standard (this will be reflected in favorable material usage variance)

- Increase in bargaining power of suppliers

- Inefficient buying by the procurement staff

Direct Material Usage Variance is the measure of difference between the actual quantity of material utilized during a period and the standard consumption of material for the level of output achieved. A favorable material usage variance suggests efficient utilization of materials. An adverse material usage variance indicates higher consumption of material during the period as compared with the standard usage.

Reasons for a favorable material usage variance may include:

- Purchase of materials of higher quality than the standard (this will be reflected in adverse material price variance)

- Greater use of skilled labor

- Training and development of workforce to improve productivity

- Use and improvement of automated manufacturing tools and processes

Reasons for adverse material usage variance include:

- Purchase of materials of lower quality than the standard (this will be reflected in a favorable material price variance)

- Use of unskilled labor

- Increase in material wastage due to depreciation of plant and equipment

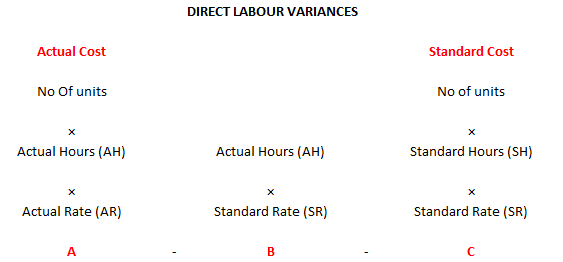

A – B = Labour Rate Variance

B – C = Labour Efficiency Variacance

NOTE : If answer is positive(+ve) – Adverse (A), Negative (-ve) – Adverse (A) – Favourable (F)

Direct Labor Rate Variance is the measure of difference between the actual cost of direct labor and the standard cost of direct labor utilized during a period. A favorable labor rate variance suggests cost efficient employment of direct labor by the organization. An adverse labor rate variance indicates higher labor costs incurred during a period compared with the standard.

Reasons for a favorable labor rate variance may include:

- Hiring of more un-skilled or semi-skilled labor (this may adversely impact labor efficiency variance)

- Decrease in the overall wage rates in the market due to an increase in the supply of labor which may be caused, for example, due to the influx of immigrants as a result of the relaxation of immigration policy

- Inappropriately high setting of the standard cost of direct labor which may, in the hindsight, be attributed to inaccurate planning

Causes for adverse labor rate variance may include:

- Increase in the national minimum wage rate

- Hiring of more skilled labor than anticipated in the standard (this should be reflected in a favorable labor efficiency variance)

- Inefficient hiring by the HR department

- Effective negotiations by labor unions

Direct Labor Efficiency Variance is the measure of difference between the standard cost of actual number of direct labor hours utilized during a period and the standard hours of direct labor for the level of output achieved. A favorable labor efficiency variance indicates better productivity of direct labor during a period. An adverse labor efficiency variance suggests lower productivity of direct labor during a period compared with the standard.

Causes for favorable labor efficiency variance may include:

- Hiring of higher skilled labor (this may adversely impact labor rate variance)

- Training of work force in improved production techniques and methodologies

- Use of better quality raw materials which are easier to handle

- Higher learning curve than anticipated in the standard

Reasons for adverse labor efficiency variances may include:

- Hiring of lower skilled labor than the standard (this should be reflected in a favorable labor rate variance)

- Lower learning curve achieved during the period than anticipated in the standard

- Decrease in staff morale and motivation

- Idle time incurred during a period caused by disruption or stoppage of activities (idle time variance may be calculated separately from the labor efficiency variance to reflect the underlying increase or decrease in labor productivity during a period)

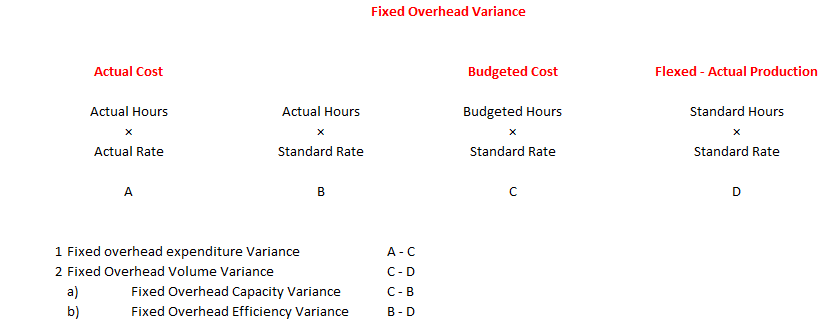

Fixed Overhead Expenditure Variance, also known as fixed overhead spending variance, is the difference between budgeted and actual fixed production overheads during a period. Favorable fixed overhead expenditure variance suggests that actual fixed costs incurred during the period have been lower than budgeted cost. Adverse fixed overhead expenditure variance indicates that higher fixed costs were incurred during the period than planned in the budget.

Reasons for a favorable variance may include:

- Planned business expansion, which was anticipated to cause a stepped increase in fixed overheads, not being undertaken during the period.

- Cost rationalization measures carried out during the period aimed at reducing fixed overheads by elimination of inefficiencies (e.g. through process re-engineering and optimization of the usage of shared resources and facilities).

- Planning inaccuracies (e.g. actual salary raise being lower than anticipated in budget).

An adverse variance may be caused by the following:

- Expansion of business undertaken during the period, which was not taken into consideration in the budget setting process, causing a stepped increase in fixed overheads.

- Inefficient fixed overheads management (e.g. due to empire building pursuits of senior management).

- Planning errors (e.g. increase in insurance premium being higher than budget due to changes in the risk profile of business).

Fixed Overhead Volume Variance quantifies the difference between budgeted and absorbed fixed production overheads. Fixed Overhead Volume Variance is the difference between the fixed production cost budgeted and the fixed production cost absorbed during the period. The variance arises due to a change in the level of output attained in a period compared to the budget. The variance can be analyzed further into two sub-variances:

- Fixed Overhead Capacity Variance

Fixed Overhead Capacity Variance calculates the variation in absorbed fixed production overheads attributable to the change in the number of manufacturing hours (i.e. labor hours or machine hours) as compared to the budget.

The variance can be calculated as follows:

Fixed Overhead Capacity Variance = (budgeted production hours - actual production hours) x FOAR*

- Fixed Overhead Efficiency Variance

Fixed Overhead Efficiency Variance calculates the variation in absorbed fixed production overheads attributable to the change in the manufacturing efficiency during a period (i.e. manufacturing hours being higher or lower than standard ).

The variance can be calculated as follows:

Fixed Overhead Efficiency Variance = (standard production hours - actual production hours) x FOAR*

*FOAR = Fixed Overhead Absorption Rate / unit of hour