Chapter 3 - Manufacturing

Some businesses may manufacture their own products instead of trading in finished goods. A manufacturing business is the most complete form of a business because it buys raw materials, converts them into finished items and then sells these items to its customers. Businesses that make their own products must prepare a manufacturing account as part of their internal financial statements. A manufacturing account shows the cost of running and maintaining the factory. It is prepared to calculate the cost of goods produced during the year and it is also known as the production account. Cost of production includes direct cost and indirect cost.

Direct costs are expenditure which can be economically identified with a specific cost unit. It has a direct relationship with number of output (units produced). For example:

- Direct materials.

- Direct labour/ direct wages/ factory direct wages/ factory direct labour/ manufacturing wages.

- Direct expenses (example: royalties)

The total of the direct cost is termed as prime cost.

Indirect costs are factory expenses that are not directly related with the final product. It is commonly termed as factory overheads and is incurred in running the operation of the factory. Indirect cost does not vary with the level of output. Whatever be the level of production, indirect cost remains the same.

Example of factory overheads:

- Factory rent and rates

- Factory machinery’s depreciation

- Factory insurance

- Factory supervisor's salary

- Indirect materials

- Indirect labour

- Indirect wages

- Factory light and heat

- Depreciation of Factory NCA

Items not included in the manufacturing account but treated as an expense in the income statement:

- Office rent and rates

- Office insurance

- Sales staff wages

- Carriage outwards

- Discount allowed

- Depreciation of office non-current assets

- Administrative, selling and distribution cost

- Finance cost

- General expenses, sundry expenses, advertising cost

- Bad debts and provision for doubtful debts

Inventories in Manufacturing Businesses

| Type of inventory | Opening inventory | Closing inventory |

| Raw Materials | Manufacturing Account | Manufacturing Account Statement of financial position |

| Work in progress | Manufacturing Account | Manufacturing Account Statement of financial position |

| Finished goods | Income statement | Income statement Statement of financial position |

Manufacturing Account for the year ended 31st December 2018 | ||

Direct Materials | $ | $ |

Opening inventory | * | |

Add Purchases | * | |

Add Carriage inwards(on purchases) | * | |

Less Return outwards(purchases return) | (*) | |

Less Closing inventory | (*) | |

Raw Materials consumed | **** | |

Direct Labour / Direct wages / Factory wages | * | |

Factory Direct expenses / Royalties | * | |

Prime cost | *** | |

Factory Overheads | ||

Factory Power, light and heat | * | |

Factory Supervisor's salary | * | |

Depreciation on Factory Non current assets | * | *** |

*** | ||

Work in Progress | ||

Opening inventory | * | |

Less Closing inventory | (*) | |

Cost of production | *** | |

Income statement for the year ended 31st December 2018 | ||

Revenue | * | |

Less return inwards / Sales return | (*) | |

*** | ||

Less Cost of sales: | ||

Opening inventory of Finished goods | * | |

Add Cost of production | * | |

Add Purchases of finished goods | * | |

Goods available for sales | *** | |

Less Closing inventory of Finished goods | (*) | |

Cost of sales | (***) | |

Gross Profit | *** | |

Add other income: | ||

Discount received | * | |

*** | ||

Less Expenses : | ||

Discount allowed | * | |

Carriage outwards / on sales | * | |

Bad debts | * | |

Selling expenses | * | |

Administrative expenses | * | |

Depreciation of Office Non current assets | * | |

Provision for doubtful debts | * | (***) |

Profit for the year | *** | |

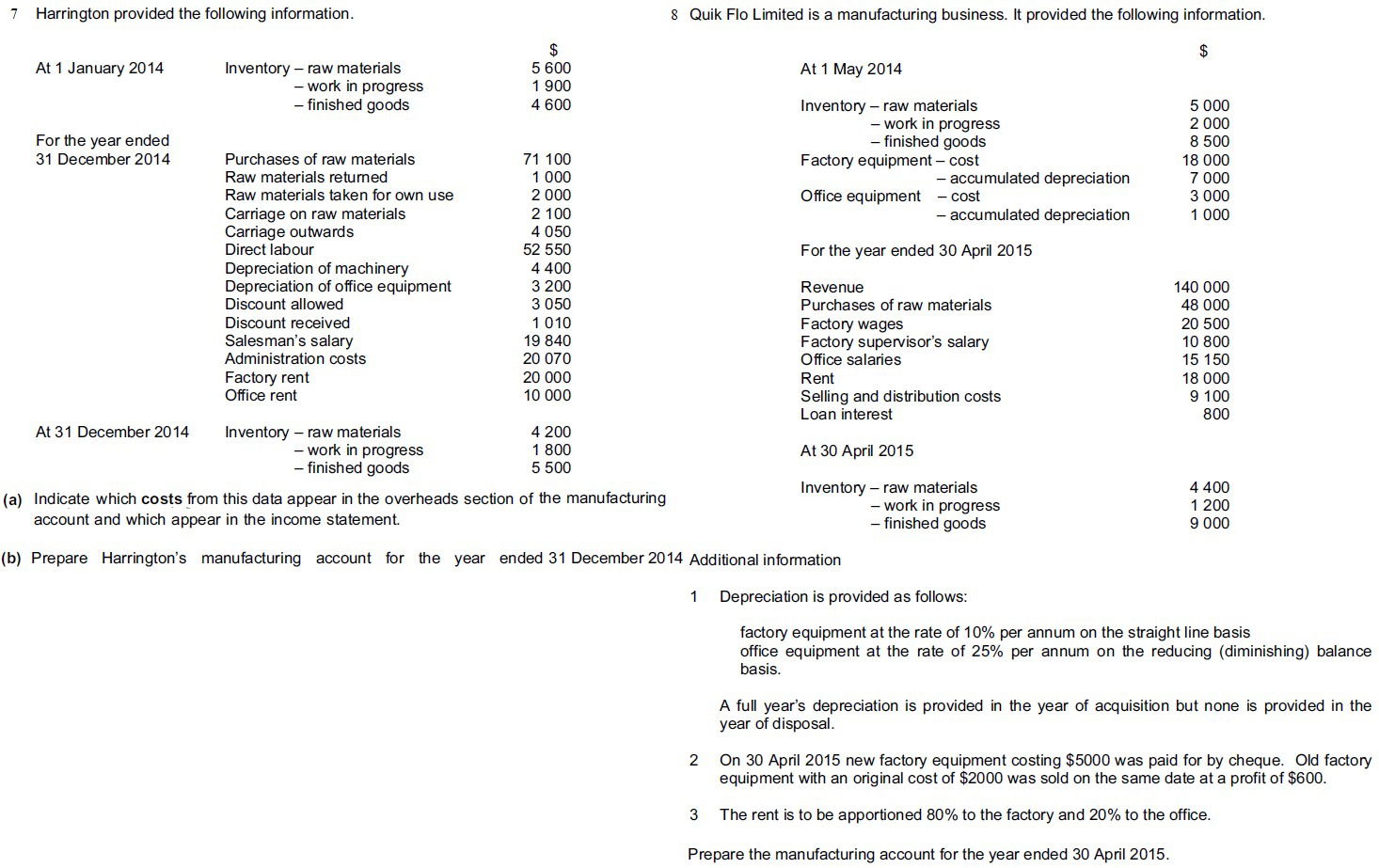

Question 1, 2 and 3

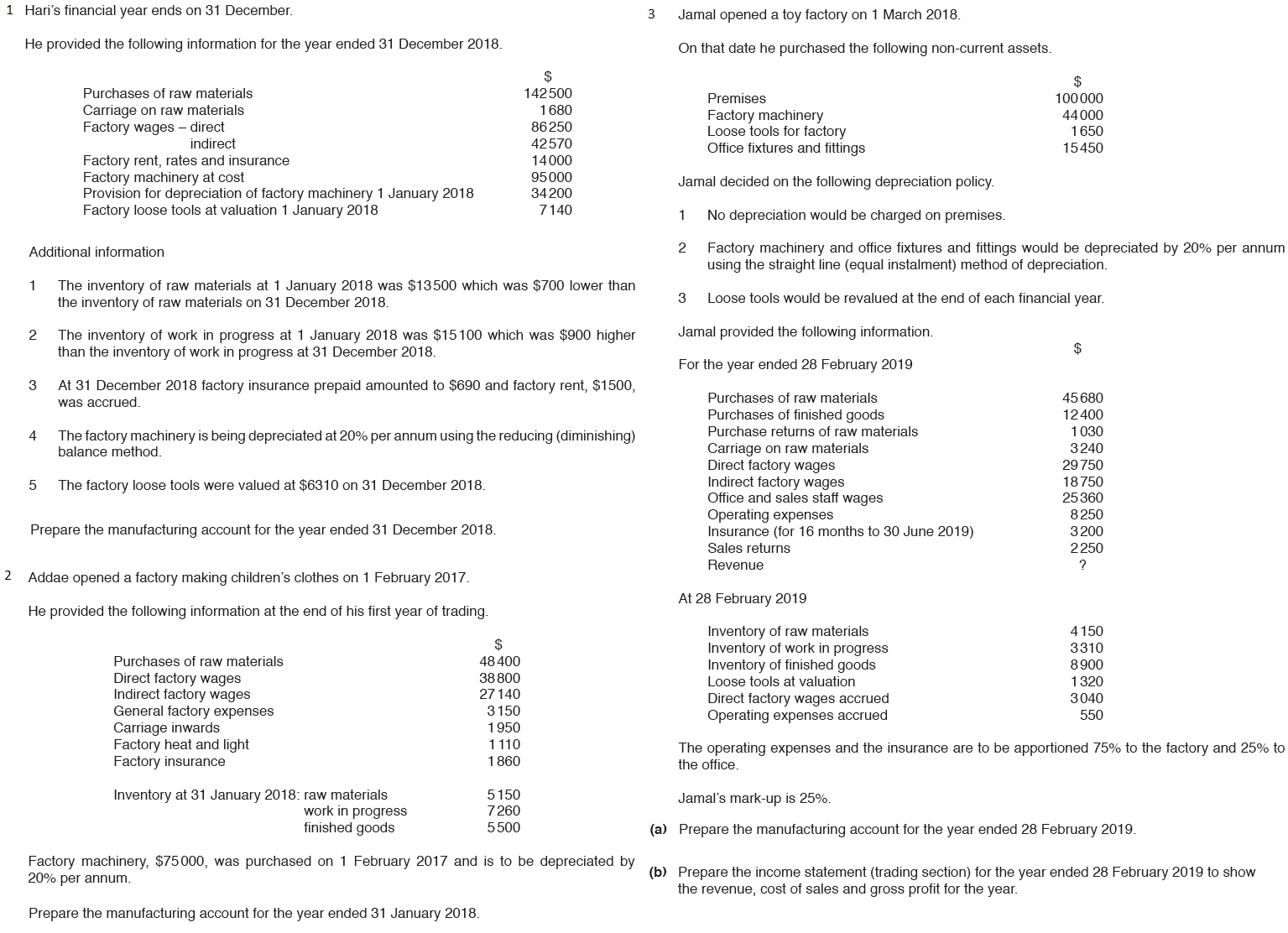

Question 4, 5 and 6

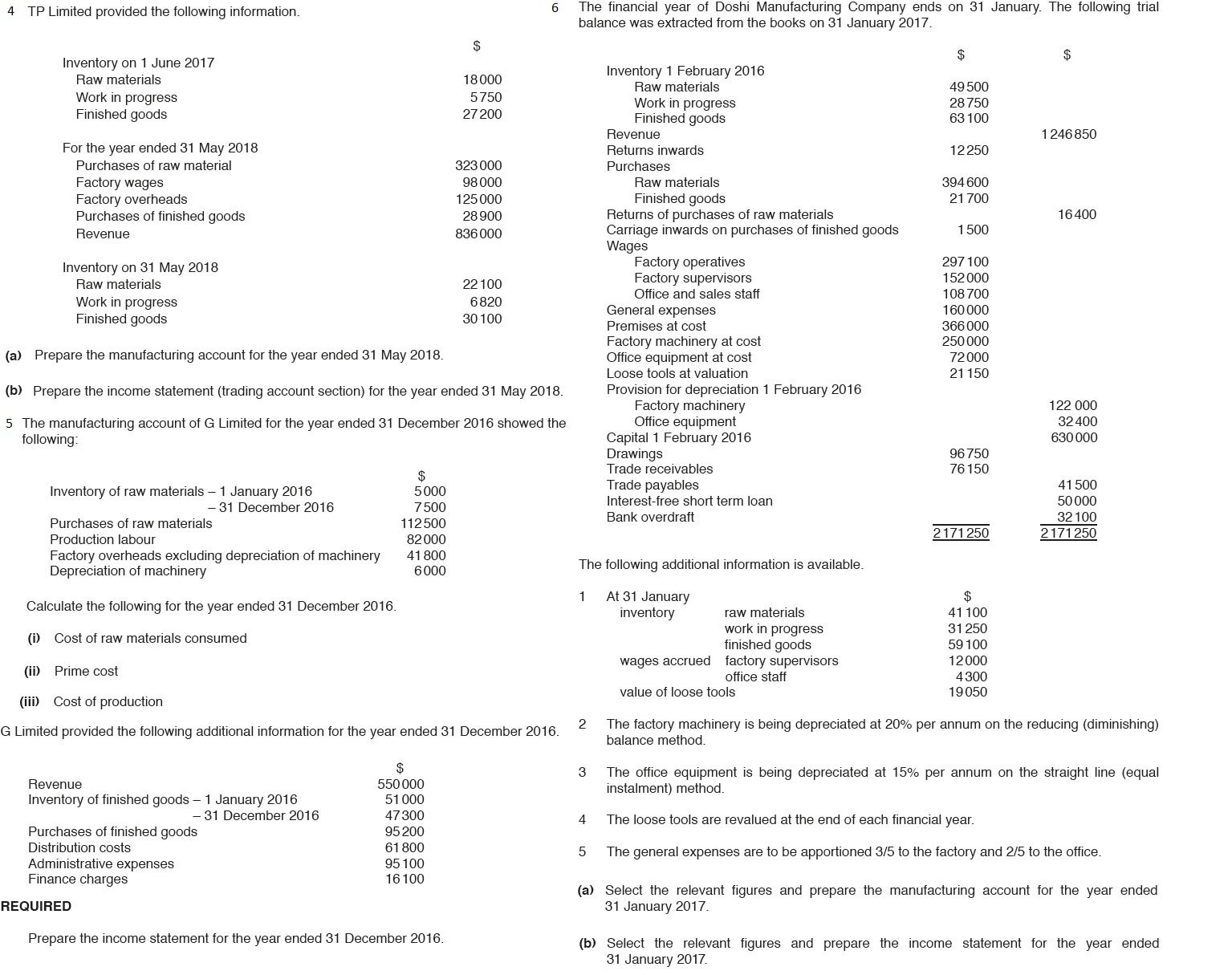

Question 7 and 8