IAS 8 Accounting Policies, Changes in accounting estimates, errors

The Standard IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors tells us:

- How to select and apply our accounting policies;

- How to account for the changes in accounting policies;

- How to account for changes in accounting estimates; and

- How to correct errors made in the previous reporting periods.

Accounting Policy

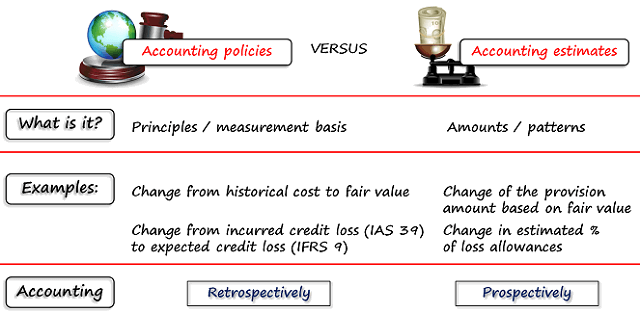

Accounting policies are anything from rules, guidelines, conventions, principles and similar norms used by entities for the preparation of the financial statements. IAS 8 specifically points out that the measurement basis is an accounting policy rather than accounting estimate.

When there is NO specific standard dealing with a transaction or item, then management needs to use judgement and develop its own policy. If there is a specific standard for a transaction, then it must be simply applied.

An accounting policy can be changed only at 2 circumstances:

- When it is required by another standard.

- When new accounting policy provides better, more reliable and relevant information.

Changes in accounting policies can be applied retrospectively. “Retrospectively” means going back to the previous reporting periods and restating every single component of equity as if the new policy had always been in place.

Accounting Estimates

When you change the accounting estimate, you change either some amount of an asset or a liability, or pattern of its consumption in both current and future reporting periods.

Typical examples of changes in accounting estimates are:

- Bad debt provisions,

- Depreciation rates and useful lives of your assets.

A change in accounting estimates is applied prospectively, either:

- In the current reporting period (as an adjustment)

- In both the current and future reporting periods

“Prospectively” means that comparatives and equity are not restated. Financial statements in the previous reporting periods are not altered (simply adjust calculations in the current and future reporting periods).

Errors

Prior-period errors are some omissions from or misstatements in the financial statements as a result of ignoring or misusing the information that was available or could be reasonably obtained when preparing these financial statements.

- If the error is NOT material, then corrections is made in the current reporting period.

- If the error IS MATERIAL, then corrections must be applied retrospectively (restating figures in the previous periods)